Federal tax law section 179D provides significant tax deductions for building owners—and, in certain circumstances, building designers—for new or renovated commercial buildings that meet certain energy saving standards.

NOTE: In August 16, 2022, the Inflation Reduction Act was signed into law and further enhances section 179D deductions for buildings placed into service after 2022. Details and guidance will be published on this web page, as soon as they become available.

Request a Proposal!What systems currently qualify for this deduction?

Three categories are included in the energy savings standards:

- Building envelope (roof, windows, insulation, ceilings, etc.)

- Heating, ventilation & cooling (HVAC) and hot water systems

- Interior lighting fixtures

Who currently qualifies?

- Commercial building owners

- Designers of Federal, State or local government-owned facilities: architects, engineers, contractors and others

Each one of these elements has the potential of a tax deduction. The actual deduction received will depend on energy savings of the components in the final design, as well as the year the building system was put into service. (Note: contact us to learn more about eligibility standards and the requirements for computer models.)

The Commercial Building Energy Efficiency Tax Deduction—Section 179D refers to the Department of Energy (DOE) and Internal Revenue Services’ (IRS) collaborative effort to provide significant tax deductions for building owners and, for government buildings, the building designers—for new or renovated commercial buildings.

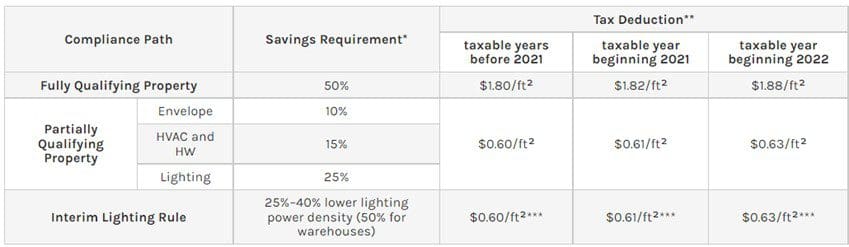

Summary of 179D Tax Deductions:

[Source energy.gov]

[Source energy.gov]

* Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting, HVAC, and hot water systems as compared to a reference building that meets the minimum requirements of ASHRAE Standard 90.1-2007 for properties placed in service on or before December 31, 2020. Savings percentages based on IRS Notice 2012-26.

** Not to exceed cost of qualifying property

*** The tax deduction is prorated depending on the reduction in Lighting Power Density (LPD). See IRS Notice 2006-52 for the definition of “applicable percentage.”

Learn more about Criterium Engineers’ additional Energy & Sustainability Services including LEED design/certification, Energy Star certifications, energy audits, and more.

Request a Proposal!